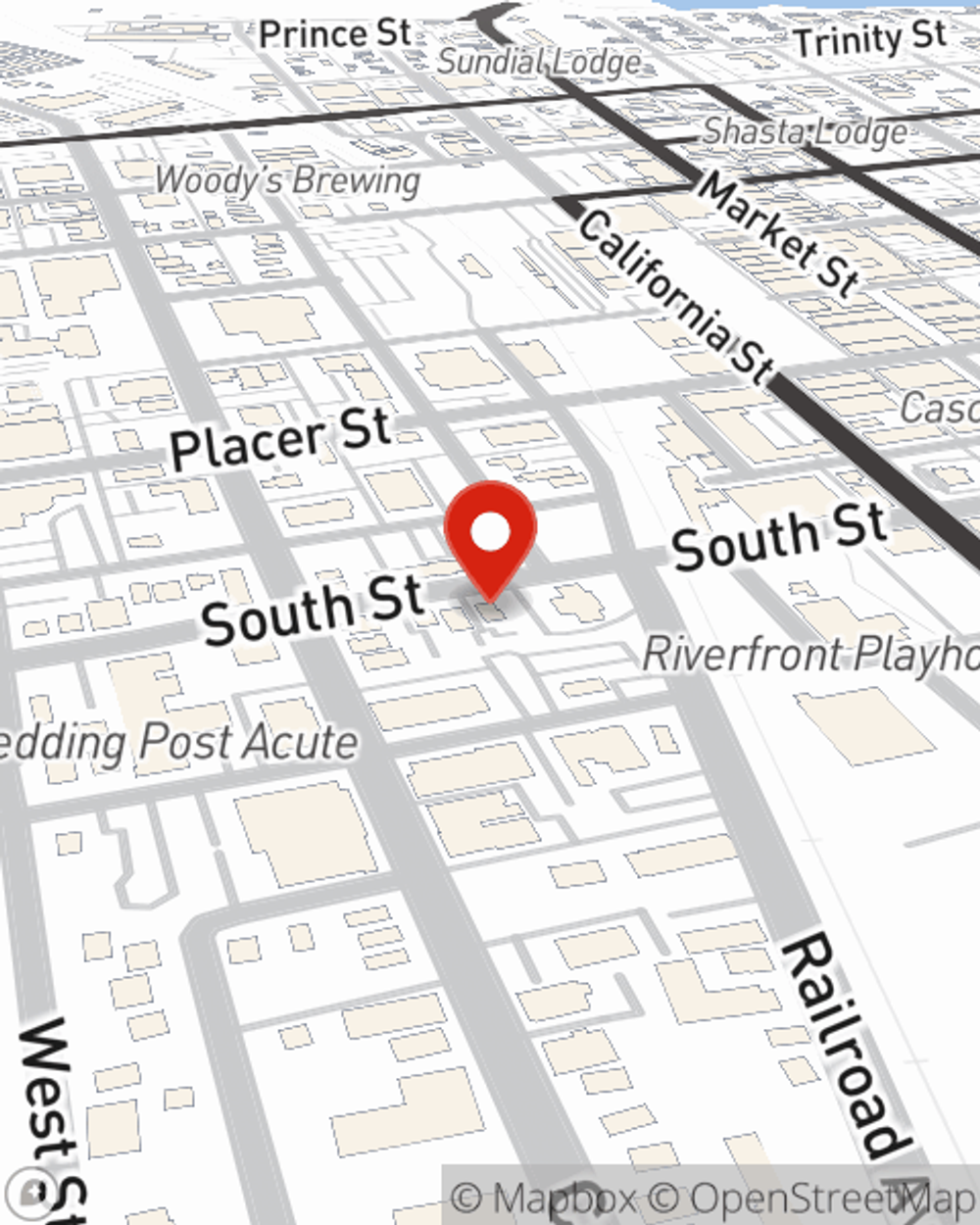

Business Insurance in and around Redding

One of Redding’s top choices for small business insurance.

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Dee Stover is not unaware of the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to consider.

One of Redding’s top choices for small business insurance.

Helping insure small businesses since 1935

Protect Your Business With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a drywall installer or a plumber or you own a bicycle shop or an advertising agency. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Dee Stover. Dee Stover is the agent who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

Contact the exceptional team at agent Dee Stover's office to find out about the options that may be right for you and your small business.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Dee Stover

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.